Understanding Deed and Lien Documents

A deed is a written document that conveys title to or an interest in real estate. In order to make a valid and legally binding deed, it needs to have all of the following information:

- Name of grantor and legal description thereof (per seller)

- Name of buyer and legal description thereof - new owner, and

- Legal description of the property.

Additionally, the deed must fulfill all of the requirements of a standard contract. The signatories must be competent and must sign their own free will, and must have the legal capacity to perform the acts they are contracted to do.

Property cannot be transferred without a written form of deed in the legally prescribed manner. As mentioned previously, the property title is the primary mechanism of securing the right to own and control a piece of property. A deed details the rights and privileges of the title holder.

There are a variety of types of deeds.

A general warranty deed both transfers the entirety of the grantor's interest in the property but also makes it so the grantee can hold the grantor responsible for any problems that occur with the title, regardless of whether the title defects occurred during the time the grantor held the title or not.

In Texas there are five basic implied warranty deeds:

- Covenant of seisin - grantor assures the buyer that the grantor or seller owns the property and has the right to sell it

- Covenant against encumbrances - grantor warrants that the property is free from other liens or encumbrances, except those specifically listed in the deed

- Covenant of quiet enjoyment - grantor guarantees to the buyer that the title is good against any third parties who may try to bring suit to establish title

- Covenant of further assurance - grantor agrees to produce additional documentation needed to make the title good for the grantee (where the grantor has the power to fix the title)

- Covenant of warranty forever - grantor covenant covers the grantee literally forever in time if the title fails at any point in the future

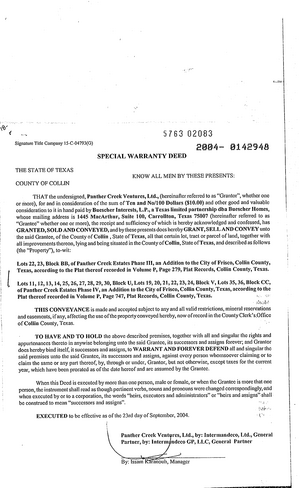

A special warranty deed is a conveyance that carries a single covenant. A special warranty deed transfers the title to the grantee while allowing the grantee to hold the grantor liable for any clouds on the title that relates to the period of time, and only then, when the grantor held the title. If there are additional warranties, those must be stated specifically in the deed, as this deed only covers one.

A deed without warranty is considered the lowest form of deed in Texas. It can also be called a bargain and sale deed. When a grantor is uncomfortable making any warranty whatsoever, they may offer a deed without warranty.

A foreclosure deed is a legal document granting property ownership to the purchaser at a foreclosure sale. Depending on the type of foreclosure, a foreclosure deed may be a sheriff's deed or a trustee's deed. A foreclosure deed transfers the legal title of property to a new owner.

A quitclaim deed, while officially transferring the property title to another person, in reality just releases the interest the grantor had in the property. It offers no guarantees or protection for the grantee of the quitclaim deed from any other clouds on the title.

Often, this kind of deed is used to quickly transfer titles between family members. Given the risk connected with a quitclaim deed, these kinds of deeds are rarely employed to transfer titles from seller to buyer.

A bargain and sale deed form is similar to a warranty deed and special warranty deed. All three convey the entirety of the grantor 's interest in the property and prevent the grantor from claiming that they had a smaller interest in the property than what was transferred to the grantee. Where a bargain and sale deed differs is that it does not have any covenants and does not require the grantor to guarantee that they actually own the property or that the property is free of encumbrances.

In Texas, a corporation is considered a legal entity. As such the corporation can transfer real property following the two basic rules:

- Corporations can convey real estate only by the authority granted in the corporate bylaws or by resolution of the corporation's board of directors.

- During the transfer, only an authorized officer for the corporation can sign the deeds. The signing of the deed will be considered prima facie evidence of the resolution allowing the signatory to sign.

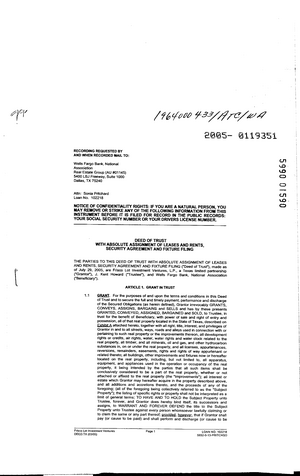

The deed of trust (or trust deed) is used for the same purpose as a mortgage. The different ways to hold title to a mortgaged property are called title theory or lien theory. In most states, most residential mortgage transactions are likely to involve a deed of trust. Three of the main elements contained in a trust deed include a date of execution, a reference to a promissory note, and a power-of-sale clause.

There are three main parties in a deed of trust transaction:

- The borrower is referred to as the grantor or trustor.

- The lender is called the beneficiary.

- The independent third party who holds the main mortgage documents on behalf of both the borrower and the lender is called the trustee or grantee.

It is up to the trustee to help with the release of the lien at the time of the borrower's payoff. The trustee will execute and issue a deed of reconveyance to the borrower once the loan has been paid back in full. The deed of reconveyance is a formal document that is proof that the property is now free and clear of any mortgage liens. Or the trustee will assist with the filing of the foreclosure process if the borrower does not make his or her payments on time.

The trust deed includes a power-of-sale clause for the foreclosure filing process and an assignment of rents clause (a section that gives the lender the right to collect the rents during times when the mortgage payments are not paid). Personal property (also known as chattel) that is part of the real property sale may be sold using a bill-of-sale instrument. Food crops sold from a farmer's land are called emblements and are considered personal property once removed from the ground. A package loan may include a combination of real and personal property.

The most important piece of information to look for in a deed of trust is the borrower's obligation. This information tells you the total sum a lender is looking to recover in case the borrower defaults on the loan.

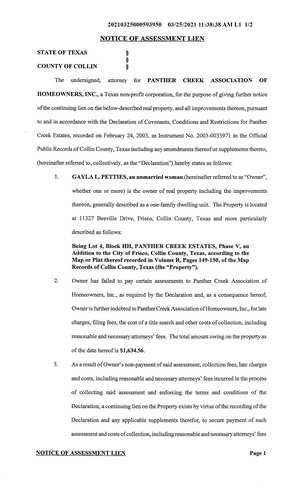

A property lien is a legal claim on one or more designated properties that may be the result of a loan granted to the owner by a third-party lender, such as a local credit union, a national bank, or a private money lender. It is typically referred to as a mortgage.

With mortgage loans, the collateral for the debt is usually the property itself. Should the mortgage borrower be unable to repay the mortgage loan consistently and on time with monthly payments or by the end of the loan term, then the lender has the right to foreclose on the property and take back the collateral asset, per the terms of their original mortgage note.

A mortgage may also be secured by two or more properties in what is called a blanket mortgage. A blanket mortgage will also likely have partial release clauses built into the loan so that an individual property may be released from the loan after a portion of the debt is paid (a common loan situation for builders of multiple homes in a new subdivision).

Liens may be created to be voluntary or involuntary by either the property owner, a third party, or by mutual agreement between the owner and a third party, such as a lender or investment partner. A mortgage loan is the most common type of voluntary lien because it takes a ready, willing, and able property buyer to seek out a lender to assist with the purchase or refinance of his or her property. An involuntary lien, on the other hand, is one in which the owner does not typically first agree to the placement of the lien on his or her property due to financial or non-financial matters. Examples of involuntary liens are unpaid taxes, legal judgments, child support, or financial claims from contractors or subcontractors for work performed on the property.

An encumbrance may be structured as a specific lien. A lien that is placed upon just one designated type of property is a specific lien. Prime examples of specific liens include a trust deed secured by a mortgage loan, a mechanic's lien, a property tax lien, and a lis pendens (see below).

A lis pendens is defined as "a notice of the pendency of a legal or financial action in which the claim to real property is alleged by a third party.” The "notice of pendency of action” provides constructive notice to prospective purchasers or lenders for the subject property about the real near-term possibility of pending court action being taken, which could affect the possession, salability, and usage of the property. Because these types of lien notices are filed in public records, the entire general public is given a form of "constructive notice” about the possibility of future liens being placed against the property involuntarily. Contractors and/or their subcontractors are likely to use the lis pendens legal strategy on a new construction or remodel job so that they are paid in full by the property owner.

A general lien is a more broad-based type of lien that can affect all properties owned by a person or business entity, like a corporation. Examples of a general lien include a judgment lien from creditors for unpaid debts or court verdicts won in recent lawsuits or civil complaints, state tax liens, and IRS tax liens. Both general and specific liens may negatively impact the ownership interests in property by creating a "cloud” on the title. That cloud must be cleared up in most cases before the owner can sell or refinance the property, due to the real potential that the owner's equitable interests in the property may be much less than it appeared earlier.

This type of lien is the equivalent of someone else filing a "hold " on an owner's property. It is usually filed by an unpaid contractor, subcontractor, laborer, or material supplier. It is generally filed in the same county recorder's office where the subject property in dispute is located. If the lien is not resolved in a timely manner by the property owner, the person or business that filed the mechanic 's lien may be able to start foreclosure proceedings against the property and force its sale in order to get paid in full, plus any interest, legal, and filing fees.

The property owner still has potential legal and financial risks even if he or she pays the designated general contractor, who is in charge of the entire new construction or remodel project. The general contractor might have 20 to 50 subcontractors, day laborers, and material suppliers working on the job site.

Even if the owner or developer pays the general contractor in full each week or month for their expenses, that also includes funds for payment to the subcontractors and other parties. If the contractor keeps the money, the subcontractors working under the general contractor's license may initiate their own mechanics liens against the owner. As such, owners and developers must be absolutely certain that the general contractor hired for the job site is both honest and financially stable.

After the filing of a lis pendens claim by a contractor or other parties who performed labor and/or provided supplies, warning the property owner about the potential of an impending court action against the property owner, the next questions to ask and steps to take in the mechanics lien may include:

- Is the construction worker legally considered a prime contractor or subcontractor? Even workers with a general contractor license issued by the state may not be legally designated as a "prime contractor” in the deal if they do not have a direct contract with the property owner.

- The subcontractor must try to find out if there was a formal "completion" of the construction project or a "cessation of work” on the project. A completion of a project occurs when the entire construction project assignment is done, which includes the owner's receipt of final inspection approvals by local planning agencies and the issuance of a Certificate of Occupancy form confirming that the property is officially complete under the law.

- A "cessation of work” can occur when all work on the project by contractors and subcontractors has stopped for a continuous and uninterrupted period of at least 60 days. This may be a sign that the owner or developer has run out of access to either their own personal cash or funds from their construction lender. If the financial trouble is really bad, then the subject property may later end up in foreclosure and the owner might wind up in bankruptcy court. If so, then many of the workers on the job site might end up with no more payments for their services performed or materials supplied. A foreclosure and bankruptcy example like this is another reason why workers on construction sites should file their mechanics lien claims as soon as possible so that they have a higher priority for payoff ahead of other financial claimants.

- With a "completion” or "cessation of work” situation, a subcontractor must file their recorded mechanic's lien within 60 days. A general contractor, who has a direct signed contract with the owner, has up to 90 days to file their mechanics lien notice after the completion or cessation of work.

- Owners can shorten the 60 and 90-day time requirements for general contractors and subcontractors to file their mechanic's lien notices by filing and recording their "Notice of Completion” or "Notice of Cessation” forms with the County Recorder within 10 days of those events occurring.

- Mechanics liens can quickly expire unless the contractor or subcontractor takes action to enforce their lien within 90 days of when the mechanic's lien was first recorded.

- The party requesting the mechanics lien may have the right to request a foreclosure action within 90 days after the recordation date of the mechanic's lien. Otherwise, the mechanic's lien will likely be void or worthless, and the filing party will probably lose his or her right to collect or foreclose.

- A Notice of Non-Responsibility filing by a property owner may occur in the following type of scenario: A tenant of a large industrial property hires subcontractors to remodel the interior of a 100,000 square foot site without properly notifying the owner about the job assignment. Since a large commercial building remodel can run into the hundreds of thousands of dollars, the owner would be wise to quickly file a notice of non-responsibility action within 10 days of becoming aware of the unapproved construction work to protect and minimize the financial risks.

- The recording of a mechanic's lien does not automatically guarantee that the filing contractor or subcontractor will be paid in full without filing a civil suit in court. Even if the owner owes $10,000 or more to the contractor for past services as mutually agreed to in the written contract between them, the mechanic's lien can expire after 90 days and the contractor may not have any more legal recourse to collect his or her fees. To make matters worse, the owner has the option to file in court what is known as a Petition to Release the Property from the Lien. If the owner is successful with his or her legal action, then the contractor might be required to pay the owner's attorney fees and court costs if the contractor does not quickly record a full release and reconveyance of the expired mechanic's lien.

- Often, these unpaid contractor disputes will be moved over to mediation or arbitration outside of the courtroom so that the parties work towards some sort of middle ground compromise or settlement between them.

- A mechanic's lien takes priority in a foreclosure action when the lien position is based on the original first date of work on the project instead of the more common filing date. There have been several situations over the years where a mortgage lender thought that it was in first position. For example, a lender filed a new $100,000 mortgage loan on a particular date, say March 10th. The lender did not realize that the contractor had a $20,000 unpaid construction bill due from work that started on March 1st in spite of the mechanic's lien that was later filed on March 12th. The $20,000 mechanic's lien could possibly wipe out the lender's entire $100,000 first mortgage loan just several months later if the homeowner does not take care of this unpaid mechanic's lien.

An Attachment Lien is a court order used to "attach” or seize another person's real or personal assets. When a court issues an Attachment Lien, it is providing constructive notice to the general public that the plaintiff, claimant, or secured party has a writ of attachment on the real and/or personal property of the named defendant or debtor. A writ of attachment is an involuntary, specific lien that attaches to one or more properties held by the owner and is filed in the county where the property is located.

A Prejudgment Writ of Attachment can be requested before the claimant or plaintiff wins his or her case in small claims court (up to $10,000 for individuals or sole proprietors and up to $5,000 for corporations and other entities). It may also be requested in state Superior Court or federal court (for unlimited amounts). In order to tie up the defendant's assets so that he or she cannot quickly sell them for cash and flee the area. The plaintiff must successfully prove to the court with enough evidence that the defendant engaged in fraud or other types of deceptive practices, and the plaintiff must also show the real risks that the defendant might sell his or her valuables before the issuance of a future judgment.

In court, where there is a judge alone or a judge with a 12-person jury, the party who wins the case and is awarded financial damages is awarded a judgment lien. The lien is formally established upon the recording of a document called an abstract of judgment. The judgment lien is considered an involuntary and general lien that may be recorded.

A property lien, as a result of the issuance of a judgment lien, can last for up to 10 years. During that same period of time, the lien will remain in place on the designated property unless it has been paid off. After 10 years and one day, the attachment lien will automatically be released. However, the judgment creditor has the option to renew the property lien before the expiration date. Any current or future properties owned or acquired during the 10-year time period may also be attached by the judgment lien.

The property owner must pay off the judgment lien to release the property or properties from it. Otherwise, the judgment creditor has options like filing a foreclosure notice before the property is later sold by the court after the issuance of a writ of execution.

Income, property, and special assessment taxes that are unpaid by a property owner faces the risk of having a tax lien filed against their property. These are types of involuntary and specific liens. The state has the power to foreclose on the property by way of tax-defaulted property auctions and the issuance of tax deeds. An exception to this would be if the property owner has agreed to his or her county's.

In most cases, property tax liens are higher in priority than all other liens on the property, even if the first mortgage loan was recorded 20 years before the property tax lien. During a foreclosure process, all junior liens (i.e., first and second mortgage loans, mechanic's liens, and judgments) are usually wiped out by the higher lien that was filed ahead of them.

Excluding federal tax liens, local law establishes the priority of liens. Lien priority is important because it governs the order in which liens are repaid.

Excluding federal tax liens, local law establishes the priority of liens. Lien priority is important because it governs the order in which liens are repaid.

For example, if a property valued at $250,000 has three liens against it, one each for $50,000, $75,000, and $150,000 and the owner refuses to pay one, then the unpaid lien holder can, in many cases, foreclose on the property.

If foreclosed, the property would then be sold and the proceeds used in an attempt to settle all of the liens attached to the property. If the property sells and nets the current value of $250,000 (after any taxes or fees), there would not be enough for all three liens to be paid off. Then, who gets paid depends on their priority. And the liens generally are not paid off by prorating. They tend to be first in line, first paid in full, before moving on to the next lien in priority rank.

This means it is possible for a lienholder to get paid in full, in part, or not at all, depending on the circumstances.

If the property sells for $300,000 then there shouldn't be any problem paying off all the liens. And if there is a balance after everyone has been paid back and all fees and expenses covered, that amount is delivered to the defaulting owner.

The courts determine which liens have priority and will pay off those liens first.

In this example, let's assume that the home sold for the market value price of $250,000 (and the foreclosure will not always capture full market value, although the lender will want to get as close to it as possible). Our liens and priorities are:

- The mortgage is the $150,000 debt

- The second mortgage is the $75,000 second priority

- A lawsuit judgment is the $50,000 lowest priority

The first two will be paid in full, while the bottom priority likely will have to settle for half of their money. That is, the $150,000 first mortgage and the $75,000 second mortgage will be paid in full. The last in line will have only a $25,000 pot from which to extract their $50,000. So, they will come up $25,000 short. However, they still may have other recourse against the defaulting party outside of the foreclosure process.

However, the "perfection " of a lien, as well, can have an affect on the priority of a lien. (See perfecting below.)

Federal tax liens are assessed for things like, most commonly, non-payment of federal income tax. The general rule with federal tax liens is that they follow the "first in time, first in right” principle described above. To become perfected the IRS needs to file a Notice of Federal Tax Lien (NFTL) with the county where the property is located.

Federal tax liens can be filed against either real property or private property. This means that the IRS can seize (or levy) private property, real property, income, and bank accounts.

For the purposes of real estate there are two priority issues to be considered in regards to federal tax liens.

- Federal tax liens are inferior to state property tax liens, assessments liens, and liens for utilities furnished by a governmental entity or instrumentality.

- An "instrumentality” is an organization which is operated for public purposes and is created pursuant to a state statute, such as a public library or water district

- Federal tax liens are also inferior to contractor liens, provided those liens are on a personal residence (a building that contains four or fewer dwelling units and is occupied by the owner) and the contract is for no more than $7,470 (as of 2014).

Understanding deeds and liens is crucial to foreclosure investments, as they give a clear picture of what your obligations will be as the buyer. It will also help you decide what price you should be willing to pay and which auctions to skip.